Moving our communities forward...

OVER 6 COMMUNITIES IMPACTED SO FAR

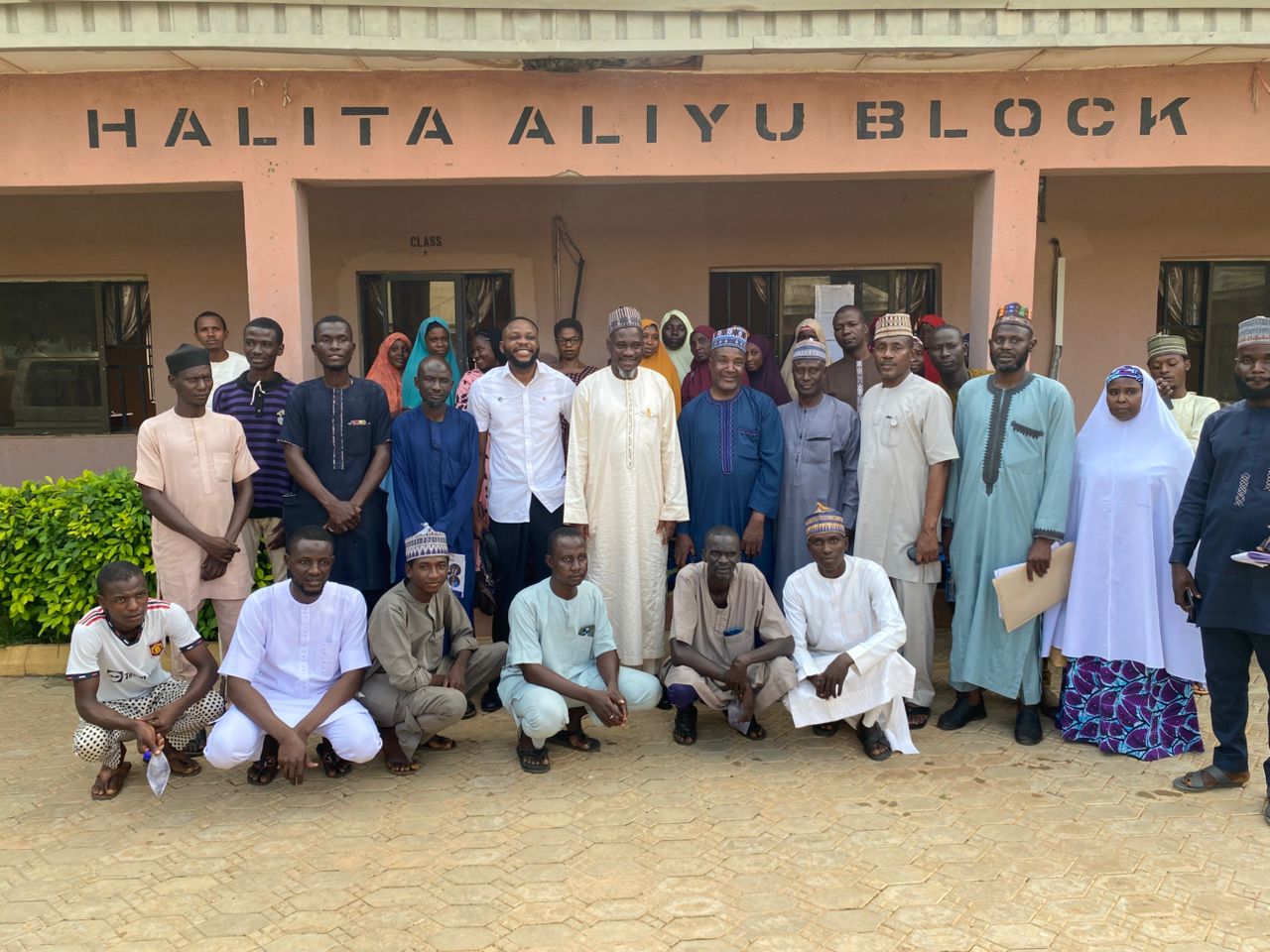

Alkali Hussaini Foundation Has Educated, Intervened, Trained and Empowered

The Less Privileged For A Better Society

ABOUT USMoving our communities forward...

Alkali Hussaini Foundation Has Educated, Intervened, Trained and Empowered

The Less Privileged For A Better Society

ABOUT US